General Questions for buying Gold and Silver

Why should I buy gold or silver physical bullion? I can buy gold ETFS, gold stocks, gold mining stocks, gold certificates. I basically own gold then, right?

No! Owning physical gold and silver bullion is the best way to go. When you are investing. GOLD ETFS, mining stocks, or gold certificates there are flaws in each of these. You will not own any physical gold or silver in your hands to touch. You are instead investing in assets that are backed by gold. There are more risks involved when not owning physical gold or silver. Let me explain.

THE DIFFERENT TYPES OF GOLD AND SILVER INVESTMENTS

GOLD OR SILVER ETFS

Gold exchange-traded funds you do not actually own physical gold or silver. You instead have invested in a stock that follows the stock market commodities sector. Gold ETFS can sometimes be leveraged as well making these stocks more volatile to move up or down.

GOLD OR SILVER MINING STOCKS

This is another option if you do not buy physical gold or silver. This type of stock invests in companies that are mining precious metals such as gold, silver, copper, palladium, rhodium, and what not. These stocks often follow the spot price of gold and the stock market. These stocks are subject to how the company is run as well. If poor management of the business occurs it can effect your investment.

GOLD OR SILVER CERTIFICATES

These certificates do not qualify as stocks technically. They represent an investment that is not physical. You have a piece of paper stating how much you own exactly, but the gold or silver is not physically in your hands. These have been becoming increasing less popular due to the United States Dollar being off the gold standard. Some companies will distribute these, but keep in mind. If the company goes bankrupt your certificate will become worth nothing, neither as well as your investment.

PHYSICAL GOLD OR SILVER

We advise you to own physical bullion you can touch. This makes you your own bank, and you now have a transferable asset. Some people view owning gold and silver just like a commodity. For example, owning cattle, corn, orange juice, oil, soy beans, and etcetera. You can go to pawn shops anywhere and turn gold or silver into cash quickly. (Quick note: If selling you should contact a gold and silver dealer exclusively. They generally give the best price when you are trying to sell your gold or silver. The other option is to sell online. You would be amazed how much you can sell on Facebook marketplace, eBay, or much more.)

When buying we believe you should buy on preference. What are you looking to do? Buy 1 big investment to put into your personal safe? Buy incrementally investing from every pay check? Buy both types? There are a lot of different types of physical gold and silver. Read Below to figure out what is best for you.

TYPES OF PHYSICAL GOLD AND SILVER

GOLD OR SILVER BARS

These come generally in 1 oz, 5 oz, 10 oz, 1 Kilo which equals 32.15oz, 100 oz, and 1000 oz. These are generally flat and rectangular pure bars of gold and silver. Easiest for stacking purposes. Easiest for buying a large amount in one purchase. For reference 1000 oz troy oz is equivalent to 71 lbs. of weight that comes in one piece.

GOLD OR SILVER COINS

Gold and silver coins are created by mints from around the world. For instance, the US Mint creates the American Silver Eagle, the American Gold Buffalo, and the American Gold Eagle. Very popular among collectors and seasoned investors. Some other major mints include the Royal Canadian Mint (Canada), the Perth Mint (Australia), Germania Mint (Germany), the China Mint (China), Mexican Mint (Mexico), The Royal Mint (Britain), and a lot more. Most popular to type of gold and silver to buy. Most sought after buy collectors and investors alike.

GOLD OR SILVER ROUNDS

Gold and silver rounds are generally pure .999 fine gold or silver. Rounds come in the most different varieties out there. Sizes can be 1 gram, 1/10 oz, ¼ oz, ½ oz, 1 oz, 2 oz, 5 oz, 10 oz, 1 Kilo which equals 32.15 oz. People love to buy rounds because they can give your stack collection variety and character. Popular mint rounds collections include but are not limited to Silver Towne Mint, Scottsdale Mint, Golden State Mint, Mason Mint, Sunshine Mint, The Ohio Mint, and much more. These are the most economical way to buy. Additionally, being smaller denominated for trading and barter.

HOW MUCH GOLD AND SILVER SHOULD I BUY?

This again, is all based upon personal preference. The traditional advice is to gold and silver should comprise of 10-20 percent of your portfolio if you are excluding real estate. We generally tell people to have 25 percent in precious metals, 25 percent in real estate, 25 percent in stocks, and 25 percent in cash. That is our general portfolio distribution that we feel gives a great hedge. Well how much gold to silver should I have? Most people say you should have 75 percent in gold and 25 percent in silver. Personally, we are opposite and have 25 percent gold and 75 percent silver. The reason for this is silver has a much better chance of potential profit returns. It is a very manipulated metal that is being held down. The stock market buyers and sellers have held precious metal pricing down for a long time. This is getting harder to do with the current environment of the BRICS currency coming into play. As well as Central Bank Digital currency taking effect in July of 2023. The system is being rolled out to use.

HOW MANY OZ OF GOLD OR SILVER SHOULD I HAVE?

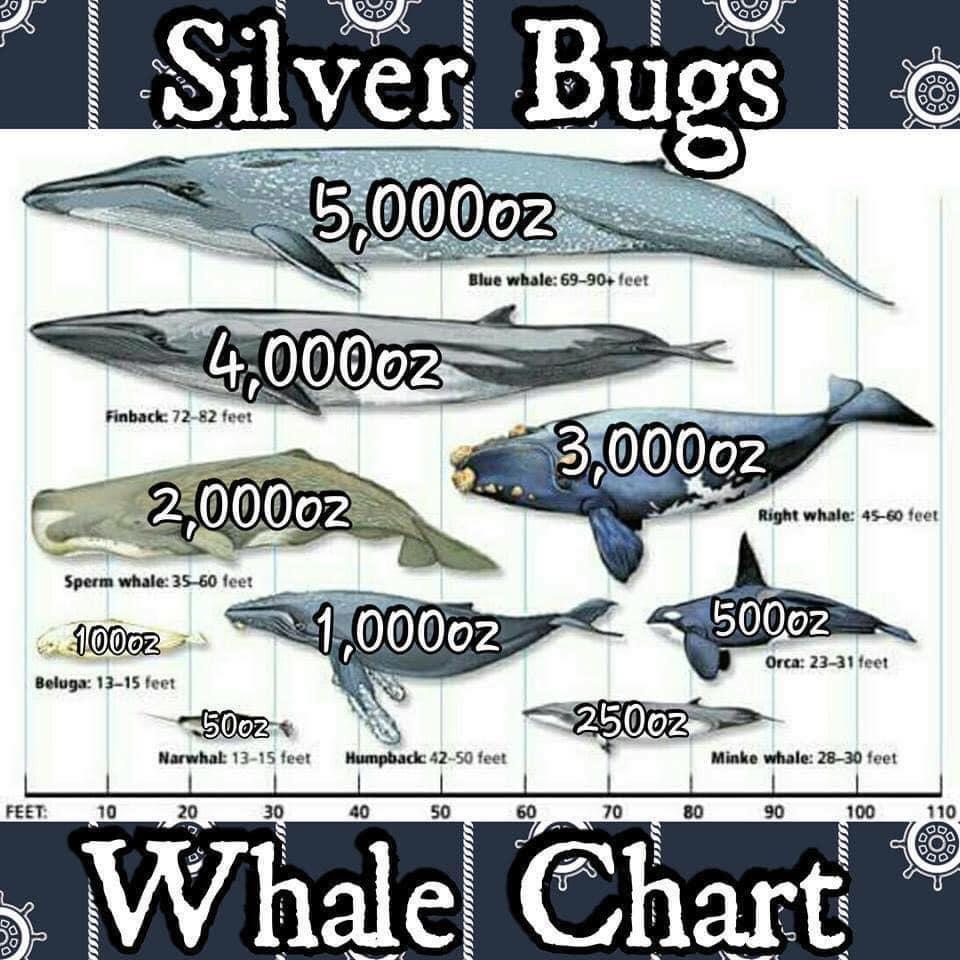

Again, this is all personal preference. Some people buy a large sum up front. Others steadily will take 10-20 percent of their paycheck and buy gold and silver. This is like a small retirement fund. This is great for future use especially if you are Millennial or Gen Z. At the current projection social security will be bankrupt by the time of retirement for the younger generations. People need to take their future financing seriously. There is a comical chart by Silver Bugs on how big of whale you are. In comparing to others with the amount of Gold and Silver you own in oz. As shown below! Any amount is a great amount to own. Just make sure it is physical.